Running a vacation rental business isn’t easy. You’re juggling nightly rates, dynamic pricing, owner statements, trust accounting, maintenance costs—the list goes on. And the financial side can get messy, fast.

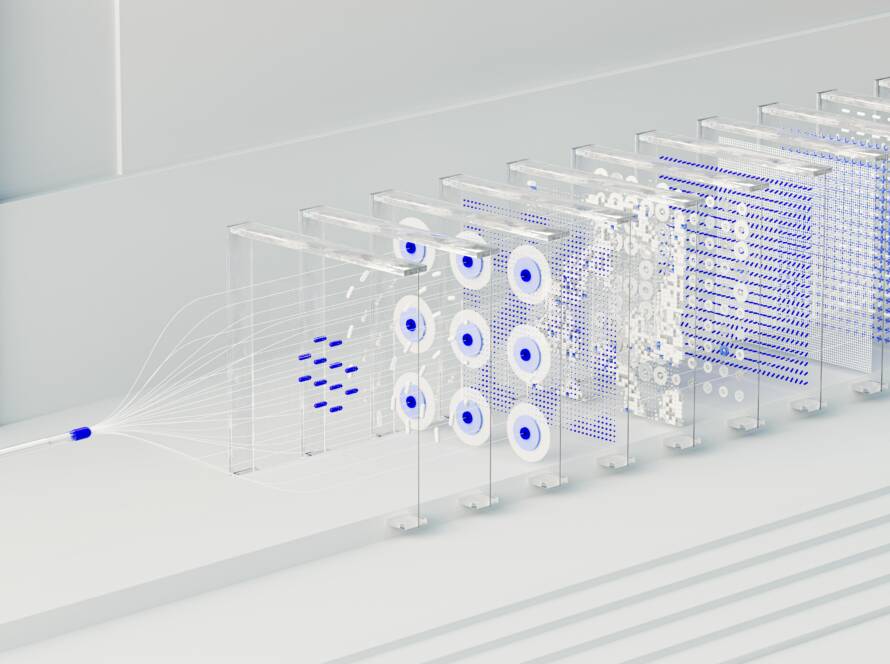

That’s why more operators are turning to automation to simplify their back office and scale more efficiently.

Let’s take booking reconciliation. If you’re manually matching data from Escapia or Track against bank statements and accounting software, you know how time-consuming it is—and how easy it is to miss something. Automation can pull in those transactions, match them to the right GL codes, and flag any inconsistencies.

Owner statements? Those can be auto-generated and even customized by property type or revenue share model. Accounts payable? Tools like BILL or Ramp can streamline approvals and issue payments without the back-and-forth emails.

But the real magic is in real-time visibility. With automated dashboards, you don’t need to wait until month-end to know how you’re doing. You can see trends in occupancy, cash flow, and expenses as they happen—which is critical when you’re operating on thin margins or dealing with seasonality.

At the end of the day, automation isn’t just about saving time (though it does). It’s about being more accurate, more proactive, and more strategic. For vacation rental companies, that edge can make a huge difference.